It can be difficult for organizations to determine what is or isn’t taxed under federal excise tax (FET). There are several factors to consider.

There is confusion in the industry and varying practice on how excise tax is applied. Because the tax is so high—12%—this can sway the decision to buy from a particular dealer. On the other hand, the liability can be large for amounts missed, especially when considering penalties.

Some key questions include:

- To which vehicles does the tax apply?

- Does FET apply to the price of the vehicle and all parts or accessories? If not, can all or some of the parts or accessories be excluded?

- How does the determination of the tax base differ, if at all, between a sale of a vehicle and a lease of a vehicle?

- Do taxable sales include both commercial and government sales?

- How do you determine the tax bases for a sale and for a lease purchase option?

We’ll address the following topics:

- Vehicle applicability and highway use

- Machinery or equipment and parts or accessories

- First retail sale and tax base

- Articles and sales exempt from tax

Overview of Retail Tax on Heavy Trucks, Trailers, and Tractors

The retail tax on heavy trucks, trailers, and tractors is a 12% tax on the first retail sale of certain heavy highway vehicles including truck chassis or body, truck trailer, and semitrailer chassis and body, and tractors. The seller is liable for the tax.

This tax provides revenue for the highway trust fund, which funds construction and repairs of public roads and highways; heavy vehicles or articles exert wear and tear on the road.

Vehicle Applicability and Highway Use

The tax is generally imposed on certain heavy vehicles for highway use, as listed below:

- Class 8 Trucks, truck chassis and bodies suitable for use with a vehicle that has a gross vehicle weight (GVW) of 33,000 pounds or more.

- Truck trailer and semitrailer chassis and bodies suitable for use with a trailer or semitrailer with a GVW of greater than 26,000 pounds.

- Tractors that have a GVW of greater than 19,500 pounds and a gross combined weight of greater than 33,000 pounds.

Definitions of Vehicles

The tax is imposed on heavy vehicles for highway use. Off-highway equipment such as agriculture, earthmoving, forestry, and mining machinery are exempt from the tax. Exemptions and exclusions do exist for certain vehicles that may be used under specific circumstances such as those used and designed for exclusively off highway activities as discussed further below. IRC Section 7701(A)(48) defines an off-highway vehicle and non-transportation trailers and semi-trailers as designed for transporting a load not on a public highway.

These vehicles have a substantially limited ability to transport a load on a highway.

The IRS uses facts and circumstances in determining whether a vehicle meets the highway specifications for the tax, including manufacturer’s brochures and website.

Substantial Limitation or Impairment

In determining whether substantial limitation or impairment exists, the IRS may weigh factors such as:

- Vehicle size

- Whether the vehicle is subject to licensing, safety, and other requirements for highway vehicles

- Whether the vehicle can transport a load at a sustained speed of at least 25 miles per hour

It’s irrelevant that a vehicle can transport a greater load off the public highway than it’s permitted to carry on a public highway.

Machinery or Equipment and Parts or Accessories

Only equipment or machinery that is considered an integral part of the chassis or body are included in the tax base. Equipment or machinery is “integral” if it contributes towards the highway transportation function of the chassis or body.

Machinery or Equipment

The following are examples of the type of machinery or equipment that may contribute to the highway transportation function of a chassis:

- Loading and unloading equipment, with some exceptions

- Towing winches

- Items contributing to the maintenance or safety of the vehicle

- Items contributing to the preservation of cargo

- Items for the comfort or convenience of the driver or passengers

Loading and unloading equipment is generally included in the tax base. However, if the equipment only provides function to items other than the vehicle, it could be excluded from the tax. Examples include cranes designed for purposes other than loading cargo.

Parts or Accessories

In general, the tax attaches to parts or accessories sold on or in connection with the sale of a taxable article if they’re considered essential for its operation or appearance, regardless of whether or not such parts or accessories are invoiced or shipped separately.

If the taxable article is sold by the manufacturer, producer, or importer without parts or accessories considered essential for its operation or appearance, the sale of such parts or accessories will be considered, in the absence of evidence to the contrary, to have been made in connection with the sale of the basic article.

Tax Applies to Accessories

For example, if a manufacturer sells a taxable tractor and the fifth wheel and attachments, the tax applies to the parts or accessories at the same rate as the tractor regardless of the method of billing or the time at which the shipments were made.

So long as the parts and accessories are sold in connection with a taxable article and serve a transportation, loading, or unloading function, the parts and accessories are subject to excise tax regardless of whether the parts and accessories are used for an unrelated purpose. Parts and accessories that are spares or replacements aren’t subject to tax.

Regulation Section 48.4061(b)(2)(a) specifies that parts and accessories for a taxable chassis, body, or tractor include any article:

- Primarily used to improve, repair, replace, or serve as a component part

- Designed to be attached to or used to add to its utility or ornamentation

- Primarily used in connection with the taxable chassis or body, whether or not essential to its operation or use.

Additionally, while tires are to be included in the tax base, the tires are entitled to a credit for taxes paid on those same tires under Section 4071—a separate federal excise tax imposed directly on tires.

First Retail Sale and Tax Base

The tax applies on the first retail sale or use unless these exceptions apply:

- There was a prior taxable sale, lease, or use of the article

- The sale qualifies under certain tax-exempt sales rules

- The seller accepts a statement signed under penalties of perjury that the purchaser intends to resell the article or lease it on a long-term basis

Long-term leases before a first retail sale are treated as a taxable sale, whereas short-term leases before a retail sale are treated as a taxable use. In both instances, the tax is imposed on the lessor at the time of the lease.

Calculating Tax Base

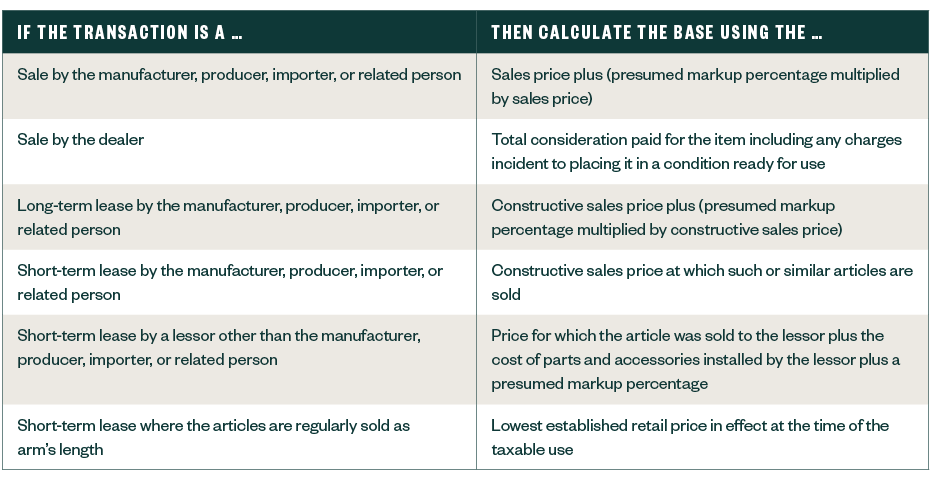

There are multiple ways to calculate the tax base in which the 12% tax is applied.

The determination depends on whether the seller is a manufacturer or retailer and whether it’s a sale to a customer or a long- or short-term lease.

- For sales of vehicles to a customer, a manufacturer, producer, or importer, the tax base is figured by taking the sales price plus an additional 4% presumed markup.

- In a sale by a retailer, figure the tax base by taking the total consideration paid including any charges toward getting it ready for use.

- For long-term leases by the manufacturer, the tax base is figured by taking the constructive sales price plus an additional 4% presumed markup.

- Long-term leases by the retailer are treated as a sale by the retailer, and the base is the total consideration paid for the item including any charges incident to placing it in a condition ready for use.

- For short-term leases by the manufacturer, the tax base is figured by taking the constructive sales price at which similar articles are sold.

Lessors Other than Manufacturers, Producers, or Importers

Lessors other than manufacturers, producers, or importers who have a short-term lease figure the tax base in one of two ways.

If the articles are also regularly sold at arm’s length, the lessor figures the tax base by taking the lowest established retail price in effect.

Otherwise, figure the tax base by taking the price for which the article was sold to the lessor and add it to the cost of parts and accessories installed by the lessor, plus the 4% presumed markup.

A helpful summary of these rules, from IRS Publication 510, is below.

If–Then Table to Calculate Tax Base

In calculating the tax base, the following are excluded:

- Retail excise tax imposed on the sale

- State or local retail sales tax if separately stated

- Value of any used component of the article furnished by the first user of the article

- Transportation charges

- Delivery charges

- Insurance

- Installation charges—other than for parts and accessories

- Machinery or equipment that doesn’t contribute to the highway transportation function of the vehicles

Additionally, repairs and modifications aren’t factored into the tax base unless the cost of the repairs and modifications is more than 75% of the retail price of a comparable new article.

Articles and Sales Exempt from Tax

The following list of some of the common sales that may be exempt from the retail tax on heavy trucks, trailers, and tractors could potentially include:

- Sales to a state or local government for its exclusive use

- Certain sales to Tribal governments (depending on use)

- Sales for use by the purchaser for further manufacture of other taxable articles

We’re Here to Help

When buying or selling heavy vehicles, it is important that an organization consider the above information regarding the retail tax on heavy trucks, trailers, and tractors. Please contact your Moss Adams professional if you have any FET questions.

You can also visit our Automotive & Dealer Services Practice for additional resources.